If Phone Giants Merge: A Rural Take

[Source: Daily Yonder, by Parul Desai, July 18, 2011]

AT&T is proposing to acquire T-Mobile. What would this mean for phone pricing, customer service and jobs in rural areas?

In March AT&T announced a proposed $39-billion merger with T-Mobile, which would reduce the number of national cell phone carriers from four to three. The merger is subject to approval by the Department of Justice and the Federal Communications Commission (FCC), which will be considering the impact of the deal over the coming months.

Approval of the merger could have profound implications for rural residents, and the impact on rural network investment, pricing and consumer choice should be carefully considered.

AT&T has stated that the merger will lead to network improvements, including faster deployment of next-generation wireless broadband technology, and greater rural network development. But groups such as Consumers Union and the Rural Cellular Association have questioned those claims, referencing the communication’s carrier’s past performance.

It is difficult to estimate how many rural residents would be impacted, since effects on roaming, pricing and market competition would extend beyond subscribed customers of AT&T and T-Mobile to the entire cell phone and broadband market.

Rural Network Development

Wireless connectivity is important for daily life in small cities and towns throughout America, just as it is in suburbs and cities. From checking and responding to emails to making credit-card payments, rural communities use wireless and broadband technology to stay connected. Rural businesses have also reaped the rewards of affordable wireless technology. Today, a small business in Plainview, Minnesota, can have the same global reach as its largest competitor, creating a level playing field.

Yet despite the importance of access for residents and businesses in rural communities, communications companies have frequently argued that insufficient demand exists to justify investment in infrastructure and coverage, and cited insufficient profitability. Rural communities have had to fight for broadband coverage, and many areas remain inadequately served with slower Internet connections, higher prices and less developed cellular networks that drop calls and cannot handle the increasing loads of data from streaming video and other applications.

Yet despite the importance of access for residents and businesses in rural communities, communications companies have frequently argued that insufficient demand exists to justify investment in infrastructure and coverage, and cited insufficient profitability. Rural communities have had to fight for broadband coverage, and many areas remain inadequately served with slower Internet connections, higher prices and less developed cellular networks that drop calls and cannot handle the increasing loads of data from streaming video and other applications.

AT&T has stated in filings that the merger will help the company to expand its networks in rural and underserved communities by providing spectrum and increasing its scale and scope to levels that can support investment. Acquiring access to T-Mobile’s cell towers would quickly add more towers to the AT&T network than could be built in the next eight years.

However, in recent testimony before the House Judiciary Committee, Rene Obermann, CEO of Deutsche Telekom, stated that T-Mobile does not have the spectrum to deploy in rural areas. He and other critics claim that the spectrum that T-Mobile controls won’t increase AT&T’s geographic reach since the companies’ networks almost entirely overlap. The issue of “spectrum crunch” or overload of the network, which AT&T insists the merger would help solve, is occurring in highly trafficked urban areas, not rural communities. (Check this link for a hefty pdf on filings on the merger with the FCC.)

Given AT&T’s track record, there is no guarantee of additional investment and development in the rural network. Past actions and performance are important to consider. Critics contend that it is not a lack of spectrum or towers that prevents rural development; they also suggest that the benefits to rural network development AT&T is promising can come without the merger for much less than the $39 billion price tag the merger will cost.

According to a Congressional Research Services report, AT&T already has a substantial amount of spectrum that it isn’t using — up to one third, according to some commentators. Tapping into that spectrum would mitigate numerous complaints of dropped calls coming from customers. A Wall Street Journal article by Martin Peers from April 29th, around the time the merger was announced, says that AT&T increased its wireless capital expenditures by only 1% in 2009 to Verizon’s 10%, despite enjoying a 60% spectrum advantage over its competitor.

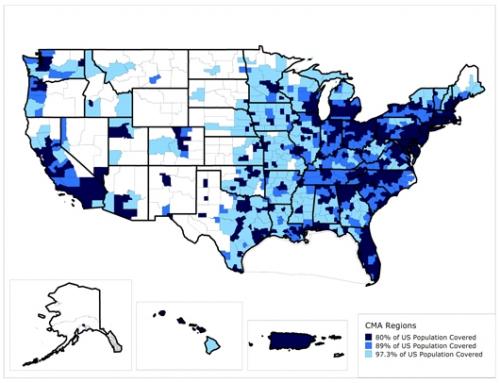

One of the greatest impediments to rural investment has thus not been spectrum, but commitment by telecommunication carriers to spend the resources on rural network development. In their filing with the FCC, AT&T claims that it has not been in its interest to deploy next-generation wireless technology beyond 80% of the market, citing a cost-benefit analysis. The merger, they argue, will provide incentive to increase that coverage to 97%. Critics point out that these numbers refer to the percent of population served, not the geographic areas or percent of the country that will be covered. Since populations are concentrated in urban centers, a tremendous number of rural residents would likely remain without service.

Claims regarding rural network development are worth examining in detail, as they do not hold up to scrutiny; a Cellular Market Areas (CMA) map illustrates the difference between covering 97.3% of U.S. population and covering 97.3% of the country. The map shows that almost 50% of the nation's land area would emain unserved if AT&T made good on its pledge to deploy to "97.3% of the U.S. population." There would still be giant swaths of rural territory where the company wouldn't provide long-term evolution broadband coverage.

While AT&T argues it needs the merger to justify investment in rural communities, those opposing the deal have argued the gains promised by AT&T are misleading and uncertain and do not justify the trade-off in competition and pricing that would result from handing over the market to AT&T and Verizon. AT&T seems focused on promises about next-generation broadband in communities where current services are in dire need of improvement.

Pricing, Competition and Jobs

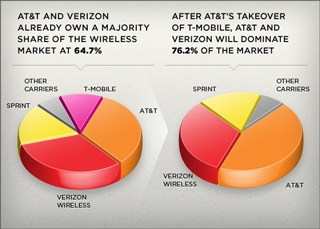

The merger would leave AT&T and Verizon with control of approximately 80% of wireless industry revenue. The removal of the competitive influence of T-Mobile, a company that has consistently competed on lower prices, would likely simplify pricing increases. Past mergers in the industry have not led to dramatic decreases in voice-plan prices.

With the reduction of national carriers to AT&T, Verizon and their smaller competitor Sprint, consumers will have fewer opportunities to take their business elsewhere in the event they are unsatisfied with the service or cost. AT&T argues that these fears are unfounded, since regional wireless providers will continue to exist.

While AT&T contends that these firms provide proof of the competitive nature of the industry, firms such as Nex-Tech Wireless, Metro PCS, LEAP, Bluegrass Cellular, Cox Wireless and Iowa Wireless Services serve limited markets: They do not offer national coverage without roaming fees; further, they often operate via prepaid phones rather than contracts, and lacking the economy of scale enjoyed by the largest players, are unable to compete for certain makes and models of phones. Steven Berry, President and CEO of the Rural Cellular Association, warned in testimony before Congress that remaining “carriers will find it increasingly difficult to survive, and consumers, at the mercy of duopoly, will face price increases and reduced innovation.”

If the merger goes through it is unlikely the two remaining larger carriers would try to compete on price. AT&T has chosen to emphasize network improvements, speeds of service and gains in network development that the merger will enable, rather than tout future pricing benefits. The company has indicated to stockholders that it plans to bring T-Mobile revenues per user up to match those of AT&T, suggesting that price increases may be inevitable.

The carriers with the most clout, AT&T and Verizon, already tend to set the pricing scheme for the entire industry. In 2009, for example, when Verizon increased its early-termination fees for smartphones to $350, AT&T followed suit less than a year later, doubling its fee to $325. An additional price survey conducted by Consumer Reports found that prices for T-Mobile plans are consistently lower, with AT&T plans on average $50 per month, or $600 per year, higher than a similar voice and data plan offered by T-Mobile.

While AT&T has stated that current T-Mobile customers will be able to keep their current pricing, this offer likely expires at the end of the contract or in the event of a device upgrade. There is some question whether T-Mobile phones and devices could actually operate on a merged network, which may necessitate that customers replace their phones right away if they want to stay with AT&T after the merger is completed.

Rural consumers may feel any potential consequences of the merger more than other customers because those who use regional carriers have historically received lower pricing on roaming services from T-Mobile when they travel to urban areas. AT&T’s charges to other carriers to allow those carriers’ customers to roam on AT&T are significantly higher than the charges levied by T-Mobile for the same roaming services, so the loss of T-Mobile may very likely result in rural consumers being forced to pay the higher rates through AT&T.

Implications for service and customer satisfaction are also a consideration. A recent Consumer Reports survey found that consumers considered AT&T a worse wireless carrier than T-Mobile in a wide range of areas, including contract service, prepaid service, customer service and call quality. Consumers also considered switching carriers more often if they were on AT&T or T-Mobile, according to the Consumer Reports survey. Overall, the survey data suggests that T-Mobile customers may face poorer service and does not suggest that AT&T’s purchase of its competitor will improve service for current customers of either company.

The economic implications of the merger are also important, and many claims have been made about the impact of the merger on jobs. Consolidation is likely to mean fewer jobs for America's workers. While publicly touting expenditures it says it might make after the merger, AT&T actually had promsed Wall Street it would reduce investment levels. This means that tens of thousands of current T-Mobile and AT&T employees would likely lose their jobs.

Conclusion

The review to approve or deny the merger will likely stretch into next year, but regardless of when it occurs the decisions made by the Federal Communications Commission in Washington, and by the corporate boards of AT&T and T-Mobile, have substantial consequences for communities who rely on wireless services. The merger may produce the most profound effects on rural customers who have already been ill served by the major communication carriers in the past. The merger could result in a less competitive system, with the remaining companies continuing to cite the same lack of incentive to invest that has hampered rural networks to date.

The FCC is currently receiving comments, and rural Americans should make their voices are heard. Public comments can be filed here.

Parul P. Desai works as Telecommunications Policy Counsel for Consumers Union, nonprofit publisher of Consumer Reports.